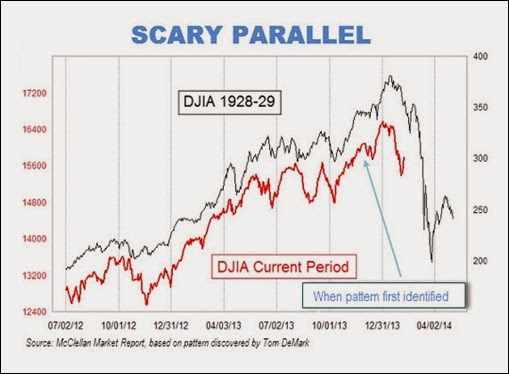

There are eerie parallels between the stock market’s recent behavior and how it behaved right before the 1929 crash.

That at least is the conclusion reached by a frightening chart that has been making the rounds on Wall Street. The chart superimposes the market’s recent performance on top of a plot of its gyrations in 1928 and 1929.

The picture isn’t pretty. And it’s not as easy as you might think to wriggle out from underneath the bearish significance of this chart.

Before you stock up on gold, guns and ammunition in preparation for a coming Great Depression Part Deux, there are a few things to keep in mind.

One is that contrary to popular belief, the 1929 stock market crash didn’t cause the Great Depression. That economic calamity was caused by a myriad of factors—an economic perfect storm, if you will. There were growing problems in the agricultural sector that drastically cut production in the heartland of the US. There was a failure by monetary policy authorities in the Fed to understand that liquidity is the mother’s milk of financial stability. In a 1963 landmark book by Milton Friedman and Anna Schwartz, the authors make a case that the Fed caused a rapid and catastrophic contraction in the money supply. Accepted economic principles state that as the money supply grows or shrinks, so do commodity prices and the value of capital. Kill the money supply, kill the economy. Explode the money supply, explode the economy.

Second, there are a number of structural and institutional controls in place now to prevent the sudden evaporation of calm and confidence that together slaughtered financial markets in 1929. Trading rules are exquisitely better defined now, such that a runaway collapse on the NYSE and NASDAQ are automatically halted before they begin (that’s an oversimplification, but I’m trying not to bore you).

Three is the fact that the Fed now takes seriously its role as the “lender of last resort,” which you saw in play during the financial crisis of 2008-09. The Fed will keep the spigot on in any crisis that might manifest itself in 2014, just as it did in 2008.

But don’t breathe a sigh of relief just yet. From 2009 through June of last year, the Fed began a program known as quantitative easing, in which it purchased trillions in the short term obligations of financial institutions. Those institutions used the cash to invest in capital markets as well as extending loans to businesses and individuals at historically low real interest rates. Stocks recovered steadily, despite anemic growth in the broad economy. In June 2013, the Fed started tapering off on the policy, reducing the flow of money through the system and causing a nearly 700 point drop in the Dow. Chairman Ben Bernanke then decided to slow the pullback of the easing policy, but it restarted a few months later.

This is similar to what happened with the money supply in 1928-29, which could be why there is such a scary correlation between Wall Street in 1929 and Wall Street in 2014. Remember: kill the money supply, kill the economy.

In short, there’s no sustainable way to continuously pump money into the economy. Although the Fed can create money out of thin air, at some point, a massively easy credit policy can only do so much. There also has to be a responsible fiscal policy that allows the private sector to grow and recover the traction it had before the crisis began.

What’s your hope for a responsible fiscal policy with this administration?

0 comments :

Post a Comment

You must have a Google Account to post a comment.

WARNING: Posting on this blog is a privilege. You have no First Amendment rights here. I am the sole, supreme and benevolent dictator. This blog commenting system also has a patented Dumbass Detector. Don't set it off.

Note: Only a member of this blog may post a comment.