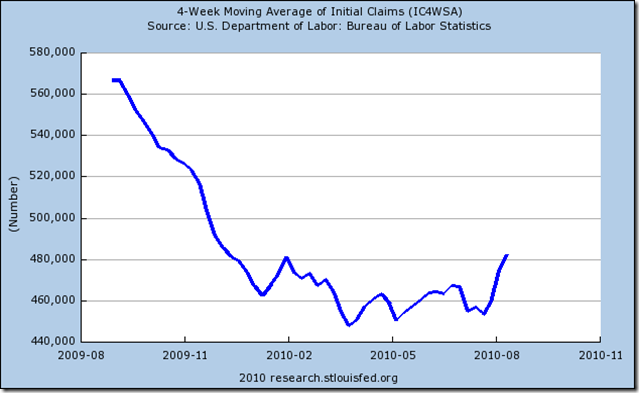

The US Department of Labor released the latest weekly jobless claims data today. These numbers are about what I expected. In the week ending Aug. 21, the advance figure for seasonally adjusted initial claims was 473,000, a decrease of 31,000 from the previous week's revised figure of 504,000 and despite the slight decrease, it’s still not good news. The 4-week moving average was 486,750, an increase of 3,250 from the previous week's revised average of 483,500. Last week’s 504,000 (revised upwards from 500,000) was something of a fluke—some decent numbers rolled off the seasonal adjustment while some really BAD numbers moved on.

Last week’s jobless claims decrease is not “unexpected,” nor does it indicate improvement in the prospects for reducing unemployment, nor does is show that we’re absolutely “moving in the right direction,” as Joe Biden exclaimed earlier this week. Don’t buy the CNN/CNBC/Reuters media spin. The job market has retreated into a shell, and businesses are getting by with who and what they’ve got until the future becomes less clouded with uncertainty (a bit more on that later).

The four week moving average, used to smooth out fluctuations from week-to-week and mitigate the impacts of weather and other factors contributing to volatility, is at its highest level in nine months. This average has been in a fairly tight range between 450,000 and 500,000 since January, and nothing indicates that a breakout is imminent. It points to a very weak job market.

This economy needs to ADD jobs, not seek solace in reductions in the numbers of jobs lost. Increases in the numbers of people filing new claims for unemployment benefits are not good news, and do not point to an improvement in a very sluggish economy.

Employers are not adding jobs because of a climate of uncertainty. They are uncertain about the effects of Obamacare. They are uncertain about the effects of newly-passed financial regulation reform (which defines almost any enterprise as a “bank” if the engage in certain risk-control activities). They are uncertain about the effects of allowing the Bush-era tax cuts to sunset, which would raise taxes on Subchapter S corporations in which the small business owner claims profits on his personal income taxes. And, in an election year, they are uncertain about the business climate in 2011 and 2012.

Gimme some feedback in the comments.

0 comments :

Post a Comment

You must have a Google Account to post a comment.

WARNING: Posting on this blog is a privilege. You have no First Amendment rights here. I am the sole, supreme and benevolent dictator. This blog commenting system also has a patented Dumbass Detector. Don't set it off.